IECE Transactions on Emerging Topics in Artificial Intelligence | Volume 2, Issue 2: 68-80, 2025 | DOI: 10.62762/TETAI.2025.191759

Abstract

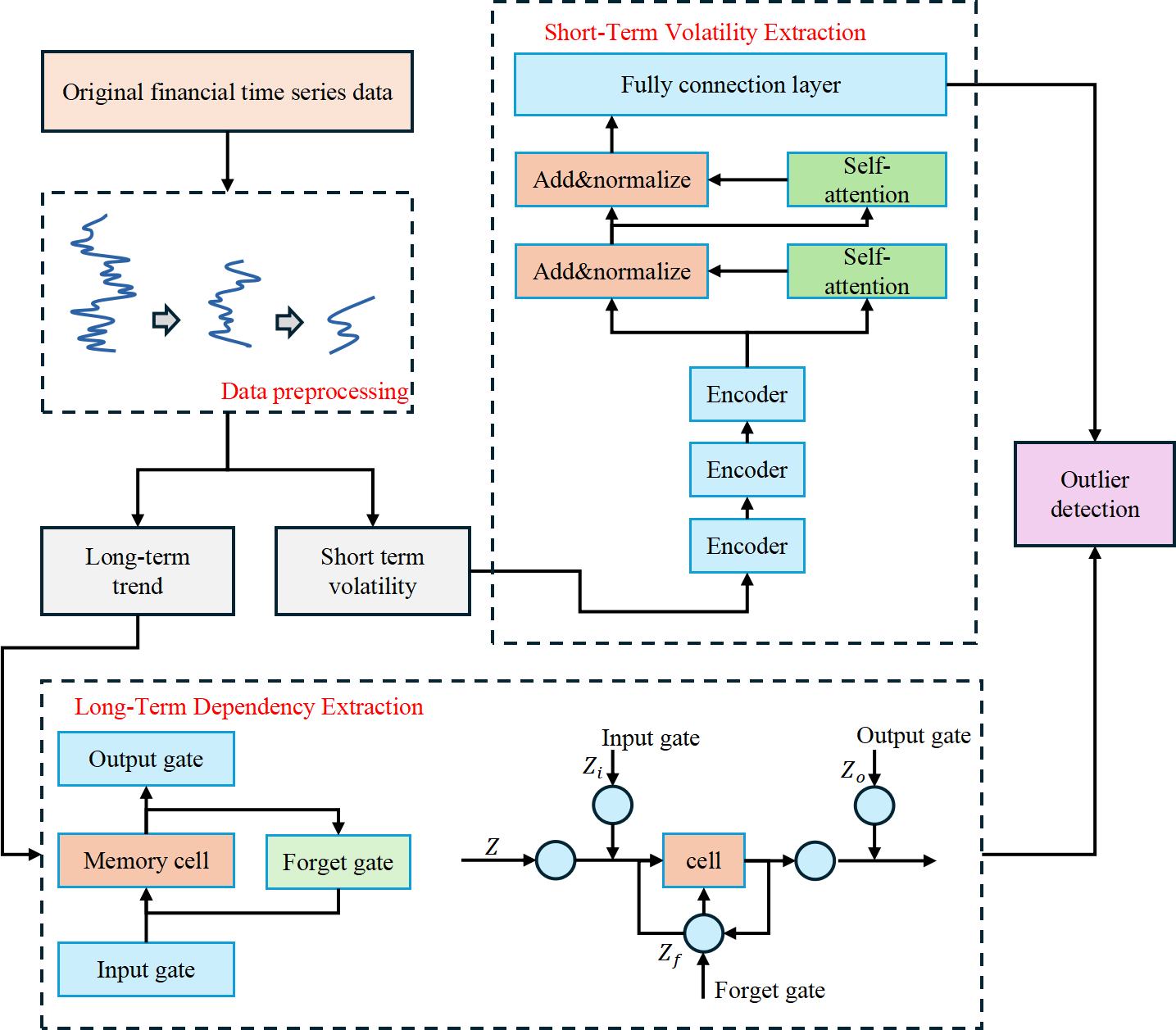

Abnormal fluctuations in financial markets may signal significant risks or market manipulation, so efficient time series anomaly detection methods are crucial for risk management. However, traditional statistical methods (e.g., ARIMA, GARCH) are difficult to adapt to the nonlinear and multi-scale characteristics of financial data, while single deep learning models (e.g., LSTM, Transformer) have limitations in capturing long-term trends and short-term fluctuations. In this paper, we propose WaveLST-Trans, a financial time series anomaly detection model based on the combination of wavelet transform (WT), LSTM and Transformer. The model first uses wavelet transform to perform multi-scale decomp... More >

Graphical Abstract